Advertisement

For taxes, you always want to pay the least amount that you owe and get the most refund that you can. Claiming tax write offs is one of the most effective ways to do this. A tax write off (tax deduction) reduces taxable income thus reduces total tax liability. It may seem like a complicated process, however, knowing what tax write offs you can use will help you save money and keep your finances in order.

In this article, we'll cover the 12 most common tax write offs you can claim on your next return. These deductions are important whether you're a freelancer, small business owner or just trying to maximize your personal tax situation.

Here are 12 common tax write-offs that could help you save money on your next return.

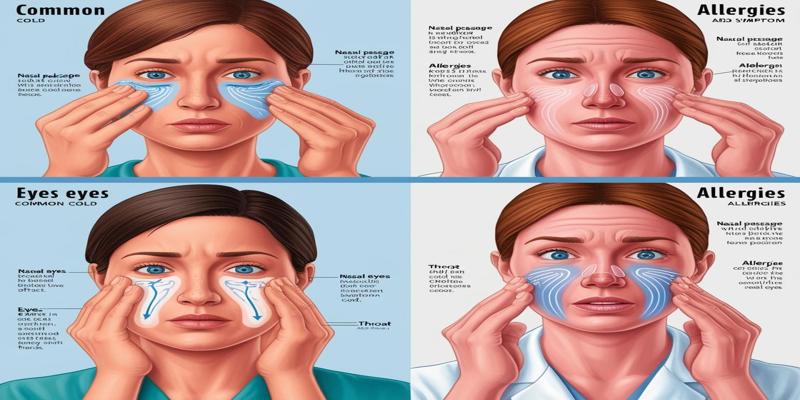

If you've had major medical or dental expenses, you may be able to deduct medical or dental expenses. It is all the out of pocket costs for treatments and prescriptions and transportation to their medical appointment. However, there's a catch: These expenses need to be more than 7.5 percent of your income for most people in 2024. If you have major medical expenses, it's worth keeping track of every last detail.

You can also include costs for long term care, medical equipment and any necessary modifications to your home for health reasons, along with basic healthcare. If you or a family member has ongoing medical needs, this write off can add up quickly.

The home office deduction is one of the most valuable write offs for those that work from home. You can claim part of your rent or mortgage, utilities and even home maintenance costs. Your home office actually has to be the place where you regularly and exclusively do business, not just an extra room or corner that you occasionally work in.

In 2024, simplified methods for calculating the home office deduction are available, along with more detailed approaches allowing you to deduct actual expenses. Whatever method you go with, make sure to record expenses and square footage of your workspace so you have evidence of it.

Making charitable donations not only feels good, but it can also benefit your tax return. You can deduct donations made to qualified charities, including money, property, or even mileage if youre driving to volunteer. If youre donating items like clothes or furniture, make sure to get a receipt from the charity, and consider appraising high-value items for an accurate deduction.

For 2024, youll still need to itemize your deductions to claim charitable donations, but the effort is usually worth it if youve made substantial contributions. Dont forget to document all donations, no matter how small.

If youve taken out a student loan and are currently repaying it, you may be able to deduct the interest youve paid on that loan. For 2024, the maximum deduction is $2,500. You dont have to itemize to claim this deductionits considered an "above-the-line" deduction, meaning you can take it even if you take the standard deduction.

This write-off can be especially helpful if youre in the early stages of paying off your loan, where the bulk of your payment may be going toward interest rather than the principal. Keep track of your loan interest payments throughout the year to ensure you claim the full deduction.

For parents, the cost of childcare or care for dependents may be partially deductible. The IRS offers a tax credit for up to 35% of qualifying childcare expenses, depending on your income. This credit applies to expenses for children under 13 or for any dependents who are physically or mentally incapable of self-care. The amount you can claim is based on the cost of care and your income level, with a maximum credit of $3,000 for one child or $6,000 for two or more children.

Contributing to a retirement account is one of the best ways to reduce your taxable income. For instance, if you contribute to a traditional IRA or 401(k), those contributions are deducted from your taxable income, potentially lowering your overall tax bill. The IRS sets annual contribution limits, so make sure you know how much you can contribute each year.

Homeowners can deduct the interest paid on their mortgage, which can significantly lower their taxable income. This deduction applies to mortgages for homes you live in as well as secondary properties, though there are limits based on the size of your mortgage and whether you file as an individual or joint taxpayer. For most homeowners in 2024, the mortgage interest deduction remains a major advantage. Keep track of the interest portion of your mortgage payments, as the lender will typically send a Form 1098 outlining the amount youve paid each year.

If youre self-employed or a business owner, you can write off a wide range of expenses related to your business activities. This can include office supplies, software, business-related travel, and advertising costs. Even meals with clients or potential customers may be deductible under certain conditions. Its important to differentiate between personal and business expenses. Keep thorough records and receipts, as the IRS can challenge claims if they believe you're mixing personal and business costs.

Whether youre paying for tuition, textbooks, or even some work-related courses, education expenses can qualify as a tax deduction. The Lifetime Learning Credit or the American Opportunity Credit can offset some of the cost of education, even if its not directly related to your current job. For 2024, these credits can be a great way to reduce your tax bill if youve taken any classes or pursued higher education.

If you live in a state with high income or property taxes, you can deduct those taxes from your federal tax return. However, in 2024, the SALT deduction is capped at $10,000 ($5,000 if married and filing separately). This deduction can apply to property taxes, state income taxes, and other similar state and local taxes.

While employee job-related expenses are generally not deductible for most workers, some professions still allow for these deductions. Teachers, for instance, can deduct up to $250 of their out-of-pocket classroom expenses. Other job-related expenses that may be deductible include uniforms, tools, and continuing education, depending on your profession.

If youve suffered losses due to a natural disaster or theft, you may be eligible to claim a deduction. The key here is that the loss must exceed 10% of your adjusted gross income, and the deduction must be tied to a federally declared disaster. These types of write-offs are relatively rare, but if youve had significant losses, they could provide substantial relief.

Claiming tax write-offs can be a smart way to reduce your tax liability and potentially increase your refund. From home office deductions to charitable donations, there are numerous opportunities to lower your taxable income. As weve outlined, the most common tax deductions are available to many taxpayers, whether youre self-employed, a homeowner, or simply trying to make the most of your available credits.

Advertisement

By Sid Leonard/Feb 28, 2025

By Juliana Daniel/Jan 05, 2025

By Vicky Louisa/Mar 17, 2025

By Kristina Cappetta/Mar 18, 2025

By Mason Garvey/Jan 23, 2025

By Sean William/Dec 15, 2024

By Isabella Moss/Mar 18, 2025

By Tessa Rodriguez/Mar 16, 2025

By Maurice Oliver/Nov 06, 2024

By Paula Miller/Mar 01, 2025

By Pamela Andrew/Mar 17, 2025

By Nancy Miller/Mar 18, 2025